Solo 401K, SD-IRA, QRP

506c for Accredited Investors

#1 Fastest growing county in the US, 6 years in a row!

This amazing sun-belt area has everything investors could possibly want – a fast growing economy, plentiful white collar jobs, a high quality of life, and a competitive cost of living.

The sponsors are so confident they are planning to invest $2M+

The sponsors love this metro and the project so much they are pouring more of their own money into the deal and plan to 4.4x their initial $450K investment to $2M or more!

Construction is underway and the construction loan is approved!

Risk is significantly mitigated because the construction loan closed in September with a repeat lender with low fees (this is a BIG deal) and the construction team is in place and construction has started.

Projected Investor Returns (5 years)

2.3x

Equity Multiple

18.1%

IRR

25.7%

AAR

8%

PREF

Request the Investor Kit

Investor Presentation (PDF)

The live presentation replay

The Detailed Investment Summary

The FAQ Document

The independent Feasibility Study

Additional project information

Where should we send your access to the Avondale Commons Investor Kit?

An accredited investor, in the context of a natural person, includes anyone who:

Has earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior 2 years and reasonably expects the same for the current year,

OR has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person's primary residence).

What We Love About This Project

Sign up for the investor presentation and discover even more things to love about Avondale Commons!

Where should we send your access to the Avondale Commons Investor Kit?

Neal’s datacentric approach gives him a near oracle like insight into the vagaries of not just commercial real estate, but also macroeconomic trends as they impact microeconomic zones and industries. His ethics are beyond reproach and his interests are clearly aligned with his passive partners.

He is what you want in a partner, someone who is scanning the horizon for both threats and opportunities, someone who can hunt for the right prey at the right time, and you both get to dine on the feast together.”

Dr. Gurpreet P., Grocapitus Investor

The Avondale Commons Project

The project is located in the city of Avondale, the keystone business community in Metropolitan Phoenix’s flourishing West Valley. It’s proximity to strategic transportation corridors and access to a skilled STEM workforce has made it the city of choice for forward thinking investors and business owners.

Avondale Commons has an appealing, modern design and highly desirable outdoor and community features. Based on our local construction experience, the project has been value engineered to optimize costs and deliver a competitive product that will attract up and coming families along with skilled healthcare and tech workers.

324-unit Class A multifamily development

Construction scheduled for completion late 2024

Mix of 1, 2 and 3 bedroom floorplans with private balconies

Desirable community and clubhouse amenities

Garage and outdoor parking

Unique, personalized design touches and integrated "work from home" flex spaces

Where should we send your access to the Avondale Commons Investor Kit?

As a Limited Partner to invest in a syndication, for me, trust is a big factor. With Neal’s vast experience in multifamily construction, data-driven approach, and creative ways in solving problems as well as straightforwardness helped in creating the trust. I look forward to working with Neal on future opportunities.”

AVINASH P., Grocapitus Investor

A Phenomenal Metro For Growth!

Located in the 3rd fastest growing state, the greater Phoenix-Mesa-Scottsdale metro is on a tear with a burning white hot economy.

#1 highest population growth (U.S. Census Bureau, 2021)

Population growth 3.2x faster than the national avg (2012 – 2022)

Job growth 6.7x faster than the national avg (2012 – 2022)

#2 in U.S. for 10-year home price increases

Strongest multifamily year on record in 2021 (Kidder Matthews Report)

Maricopa County (Phoenix-Mesa-Scottsdale) has achieved the #1 spot for population growth for a stunning 6 years in a row! The region is on strong footing and has benefited greatly from a resilient labor market and a positive migration. More people moved to Maricopa County (Phoenix-Mesa-Scottsdale) than any other county in the nation last year, according to U.S. Census Bureau. The County’s growth helped it maintain its rank as the fourth most populous county in the country with 4.485 million residents.

Phoenix has recovered ALL jobs lost during the pandemic, and has an unemployment rate of 2.7% (April 2022), which is 25% lower than the U.S. rate.

According to Marcus & Millichap, since 2020, Phoenix leads the pack for rent growth, with rents up a huge 30.7%.

Where should we send your access to the Avondale Commons Investor Kit?

“The Greater Phoenix region continues to grow in population and economic vitality. Stakeholders are dedicated to working in collaboration to further enhance a growing economy. Opportunities are boundless in the West Valley, as leaders remain vigilant in strategic planning focused on the long-term impacts.”

Chris Camacho

President and CEO, Greater Phoenix Economic Council

What Investors Love About Avondale Commons

Avondale Commons is a modern, contemporary development in the city of Avondale, in the thriving West Valley region, near the heart of the Phoenix-metropolitan area. It is the perfect addition to an area with a pro-business environment boasting an accessible skilled workforce and an incredible quality of life. It has been designed to provide the most desired conveniences for up and coming families as well as urban dwellers looking for a less dense, more relaxed suburban setting, at a more affordable price than downtown Phoenix.

Every aspect of the project, from the selection of the high growth metro, to the use of our ultra powerful Efficiency Center, has been architected to maximize income and profits while providing a high quality living experience for tenants.

Our track record on similar projects with the same development and management team, along with the unusually high demand for housing in the metro has us very excited about the potential for a resounding success. With stunning local population and job growth, we expect to see very strong demand for our units, resulting in healthy projected returns for our investors.

Our location is only 1.7 miles from the Health Tech Corridor with 70,000+ healthcare and 18,000 technology jobs. Plus, across the street is the Phoenix Children’s Specialty & Urgent Care Center with a $33.5M medical office building expansion beginning soon.

Where should we send your access to the Avondale Commons Investor Kit?

Rock Star Development and Management Team

The success of any development project hinges on the strength of the development and management team, and how well they work together. This is the third project we are doing together.

Our Coyote Creek development project in St. George UT, finished on time, even though it faced pandemic related hurdles and potential delays. Not only that, but completed Coyote Creek units are leased for $100/unit ABOVE projections, creating substantial additional equity for our investors in the project.

Our Falls at Crismon Commons project, in Mesa AZ, is now fully zoned and entitled with unanimous support from both the planning and zoning board as well as the City Council. Construction financing has been lined up and the appraisal came in significantly higher than the projected exit value, by about $5 million, which should help to meet or exceed projected investor returns.

In addition, this is the second time working together in this same metro, so we are able to leverage the same on-the-ground teams.

Where should we send your access to the Avondale Commons Investor Kit?

Inspirational image. Subject to change.

“Rent growth throughout the metro has been strong in recent years while maintaining low vacancy. There are widespread employment opportunities within the area, with more on the way.

The subject’s units are anticipated to be highly desirable, and the proposed unit mix is anticipated to be attractive to the local demographic. The subject has good retail supportive services within just one to two miles.”

Independent Market Study Conclusion – Feb 2022

Newmark Knight Frank

How We Supercharge Investor Returns

This project boasts multiple income differentiators. In addition to our vertically integrated development team, which allows us to control processes and improve efficiencies, Avondale Commons is a perfect fit for the use of our Efficiency Center (EC).

Our Efficiency Center is the ultra powerful secret sauce that boosts investor returns and also improves the life of tenants in our communities. The two main goals of the EC are simple and straightforward:

Our EC center boasts powerful stats. We currently have a run rate of nearly 20,000 tenant leads a year and 4,500 tenant appointments a year.

By applying our world class efficiency center systems, processes and resources we are able to optimize net operating income (NOI) to a level that is revered in the industry, and generate returns that make our investors very happy.

The EC played a key role in the ongoing successful lease up of Coyote Creek, including building the pre-leasing website, and capturing and nurturing a strong early interest wait list. The strength of this list has allowed us to increase rents ~$100 over proforma, based on high demand.

Where should we send your access to the Avondale Commons Investor Kit?

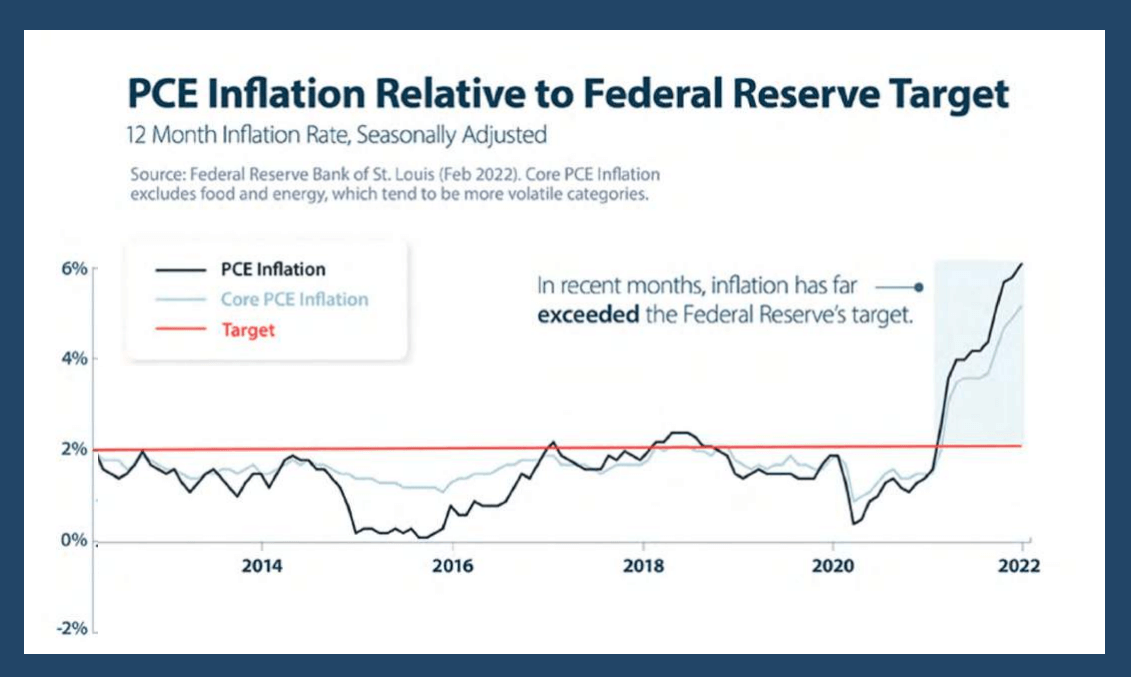

Inflation Emerges as the Silent Wealth Killer

Inflation hit a shocking 9.1% in June, at the fastest rate in over 30 years. According to Berkadia, apartments have the strongest risk-adjusted performance during both times of moderate (2-5 percent) and high inflation (5+ percent).

Investments backed by hard assets have the ability to retain value when inflation rises. Property and rental prices tend to increase with inflation, making multifamily investing an excellent strategy to hedge against inflation. Inflation is good for homeowners and landlords.

Where should we send your access to the Avondale Commons Investor Kit?

MUNAF K., Grocapitus Investor

Introducing the Team

NEAL BAWA

Grocapitus

CEO & Founder

ANNA MYERS

Grocapitus

COO

KEN HOLMAN

Overland Group

Development

MIKE HOLMAN

Overland Group

Development

DAVE HOLMAN

Overland Group

Development

DANNY BRAMER

The Cash Flow MD

Founder

How Grocapitus Selects Development Markets

Rent Growth

Sales Trends

Employment

Supply And Demand

“Neal and his team are awesome! I’ve invested in 4 projects with him and after 2 years we’ve already sold one. He’s outperformed other syndicates that I’ve invested with for much longer. I love getting his monthly updates. It’s rare to have a syndicator update us so regularly.

Grocapitus is a breath of fresh air. They do things differently and way better than their competitors. Thank you Neal for being an amazing leader to your team! I couldn’t be happier with the results so far. Looking forward to investing more in the future.”

SARAH L., Grocapitus Investor

Request The Investor Kit

Investor Presentation (PDF)

The live presentation replay

The Detailed Investment Summary

The FAQ Document

The independent Feasibility Study

Additional project information

Where should we send your access to the Avondale Commons Investor Kit?

An accredited investor, in the context of a natural person, includes anyone who:

Has earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior 2 years and reasonably expects the same for the current year,

OR has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person's primary residence).

Phase 2 Projected Investor Returns (5 years)

2.3x

Equity Multiple

18.1%

IRR

25.7%

AAR

8%

PREF