Unprecedented. Legendary. Memorable. These are the times we are living in.

The COVID-19 pandemic has turned many aspects of our lives upside down – employment, education, family life, entertainment, hobbies, and investments.

To help you navigate these unchartered waters, we are releasing a series of special bulletins to share our extensive research and reveal strategies we’ve uncovered for investors to capitalize on the historic shifts that are quickly unfolding.

Change is scary… but it’s also inevitable. As an investor, it’s vital that you learn what steps to take to protect and grow your wealth. You can find this out – and more – with this series.

Change is an opportunity. That’s what astute investors believe, and, based on the thousands of hours of research our team has done, we believe the opportunity in front of us today is MASSIVE.

There are some big challenges ahead of us, but we want you to know that Grocapitus is here to help you get the most out of your investments.

It’s important to be proactive during this turbulent time.

Our goal is not only to show you what you can do to safeguard your wealth during this unprecedented time, but what you can do to explode it multiple times higher. That’s a very bold statement, and one we intend to deliver on.

Let’s get started…

The Impact of the Pandemic on the U.S. Dollar

We are currently at a sea-change in our nation. There’s no way to sugarcoat this; this change will impact all of us. It will be most brutal for some asset classes. But it will bring huge returns for investors in some other asset classes… higher than almost anything we’ve seen in the past.

When COVID hit us like a ton of bricks, the government sprang quickly into action, printing trillions upon trillions of dollars… exploding the federal budget deficit. The Federal Reserve created dollars from scratch at an unprecedented rate to rescue the economy. Fiscal stimulus spending totalled $5.2 trillion in 2020 or about 25 percent of US GDP!

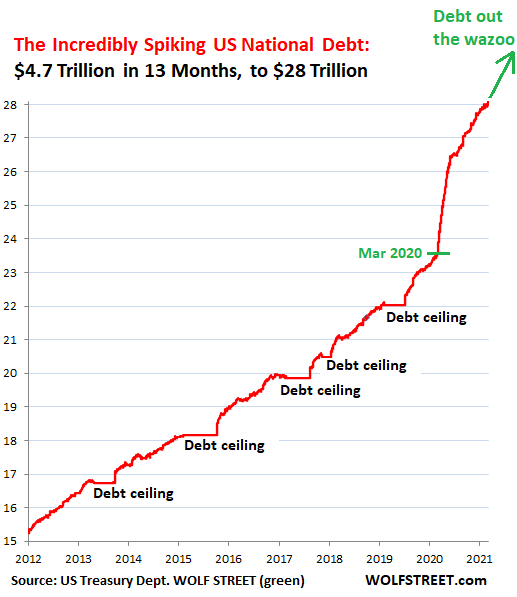

Out Of Control Deficit

And it didn’t stop there… At the time of this writing, the Senate just gave overwhelming approval to a $1 trillion infrastructure bill which the House of Representatives is threatening not to pass unless a separate, even more ambitious $1.75 trillion social policy bill is passed. And these are just 2 of the many government spending plans in the works.

The Committee for a Responsible Federal Budget (CRFB) estimates that Biden’s plans will increase the national debt by at least $5.6 trillion, and as much as $8.3 trillion, excluding any COVID-19 relief!

The federal government now overspends by more than $9 billion every single day. On a yearly basis, that amounts to $3 trillion of new debt that is being added to an already gargantuan hole.

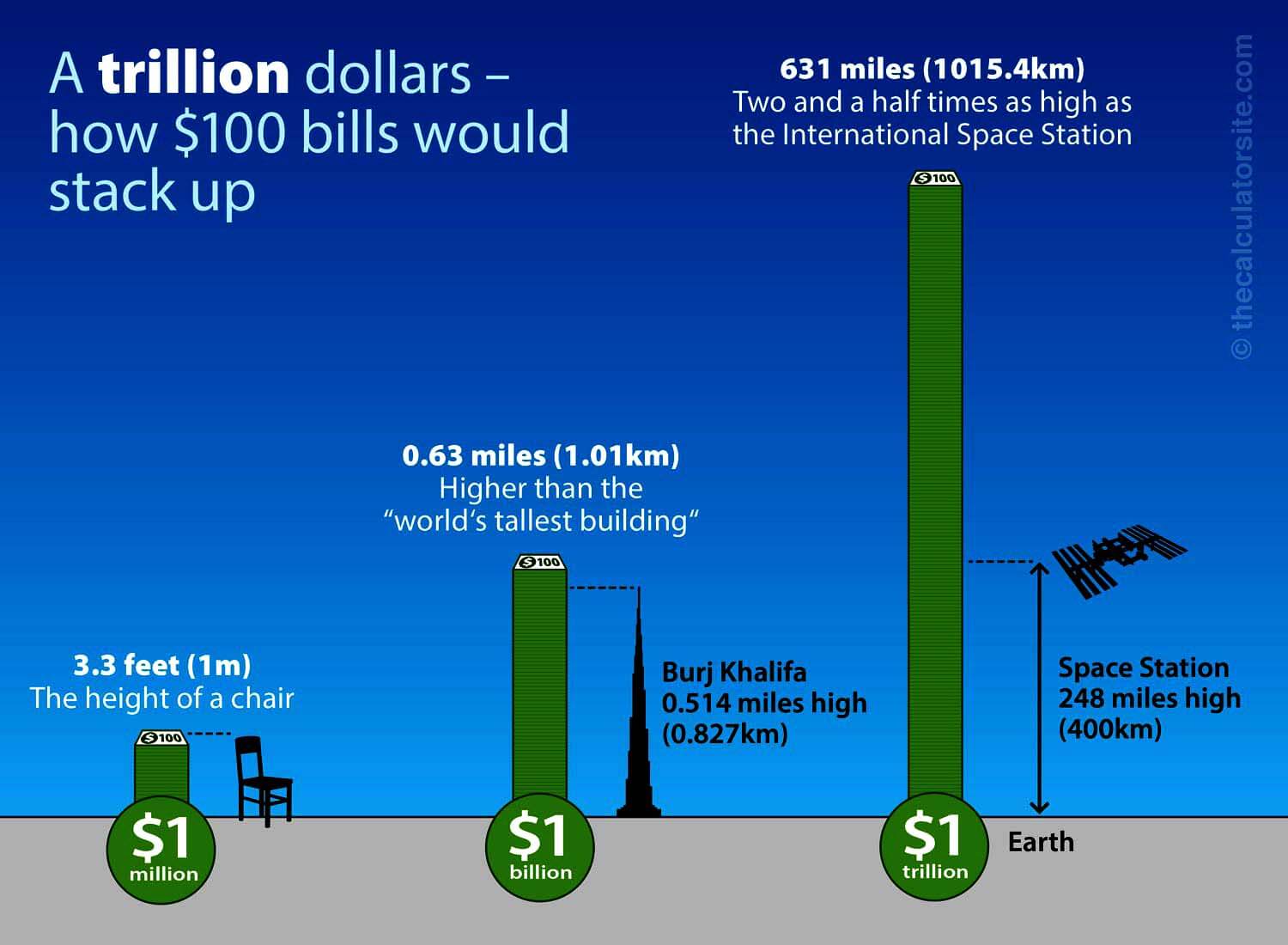

By the end of 2021 we could be facing $30 trillion in debt. It’s hard to imagine just how much money that is. To spend $1 trillion you would need to spend $1 every second for 31,710 years. If you stacked one trillion dollars using $1 bills, the stack would measure 67,866 miles and would reach more than one fourth the way from the earth to the moon.

If you stacked $100 bills it would look like this:

Here are a few more stats to put our colossal money printing into perspective. 75% of all US dollars in existence were printed during the last 12 years. 40% of all US dollars in existence were printed in the last 12 months.

But there’s more… On top of this, our country also has $162 trillion in unfunded liabilities for Medicare, Medicaid, and Social Security.

How much does the government have set aside to cover these obligations? Zero. Nada. Zilch.

And no… these unfunded obligations are NOT included in the national debt totals above.

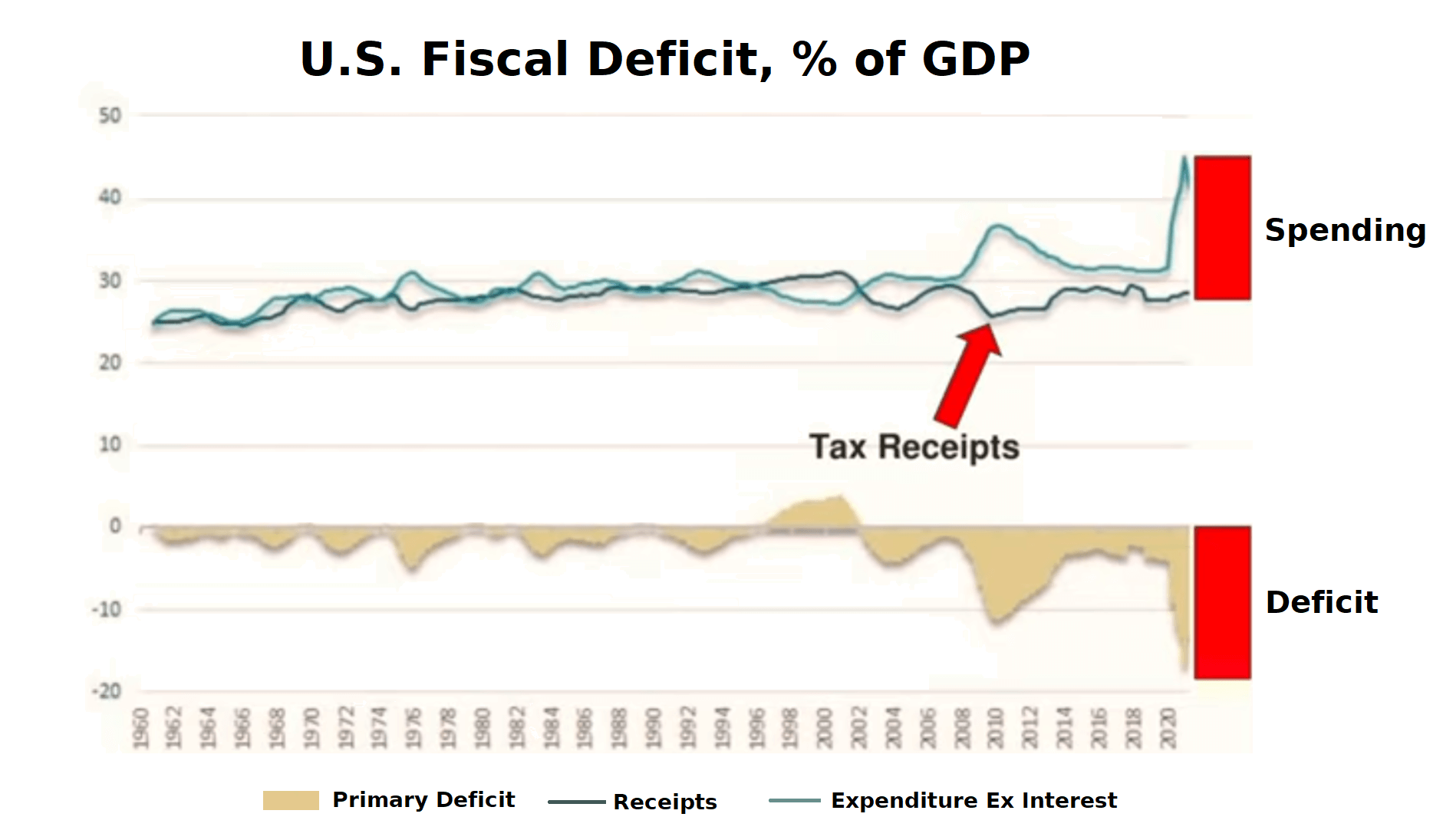

Deficit as a % of Gross Domestic Product (GDP)

Now let’s take a look at the deficit as a percentage of GDP. In a country with a balanced budget, the tax receipts are enough to cover the actual spending, including debt servicing. As you will see in the following chart, our situation is far from that.

It’s been over 20 years since we’ve had a balanced budget. It looks like we’ll never be able to do it again, given our massive debt servicing. The deficit keeps getting bigger, and bigger, and bigger.

The stimulus bills passed by Congress were a lifeboat for businesses and Americans. A necessary evil. But now, our country owes more money than any country in history, and the amount we owe will keep increasing. Our government is painted into a box, and there’s no getting out. Our debt is more than we can possibly pay back using sound monetary policies, so the only way to pay the colossal amount is with debased, devalued currency.

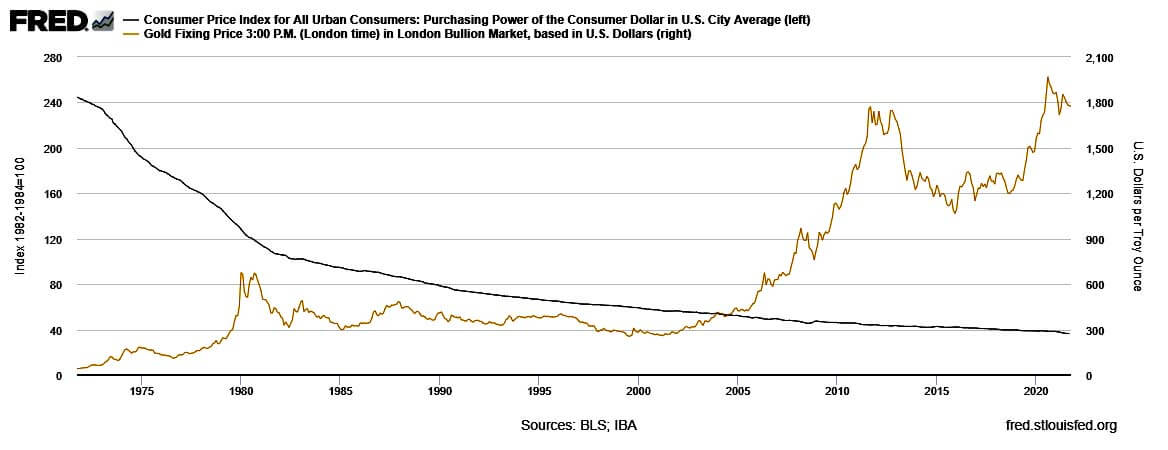

Debasement of the Dollar

As you can see above, all roads lead to the dollar’s debasement and inflation, which is already in full swing. Given the magnitude of the numbers, we could be facing one of the largest mass paper currency devaluations in history.

What happens as the money supply grows over time? The purchasing power of the U.S. dollar falls. For example, in 1944 you could buy 20 cokes for $1. Today, you can buy a small McDonald’s coffee.

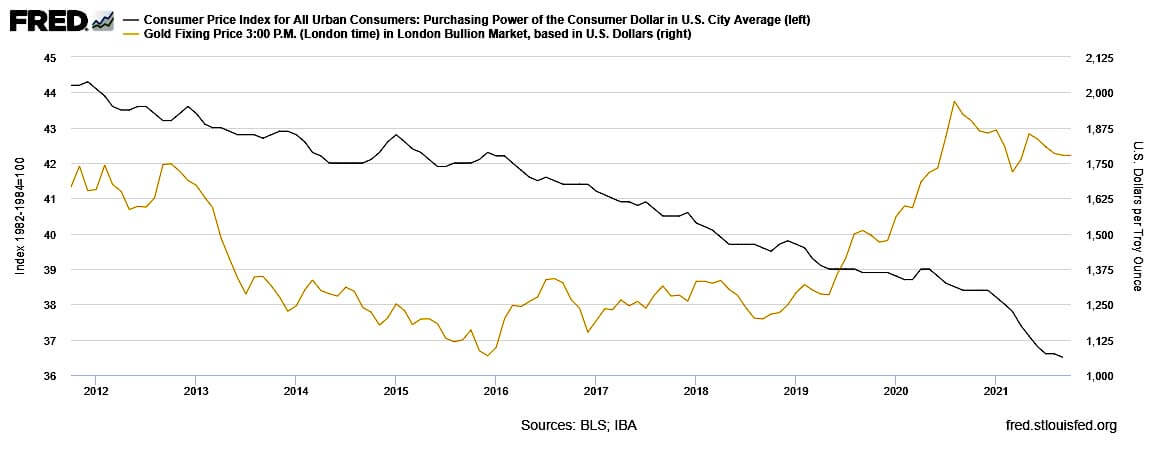

The following two charts, from the Federal Reserve Bank of St. Louis, show the purchasing power of the consumer dollar over two time-frames.

Purchasing Power of the Dollar Over 50 Years

Purchasing Power of the Dollar Over 10 Years

Today, we’re at the lowest value on record, and all roads lead to further debasement.

As the dollar continues to lose value, it acts as a hidden tax on everyone holding dollar-based assets. With a depreciating dollar, it takes more and more dollars to buy the same amount of assets — which can range from gold to stocks to real estate, commodities, cryptocurrencies and collectibles.

Bottom line is this… the more of your wealth you hold in dollars, the more your wealth depreciates.

As ominous as this sounds, we don’t expect the economy to implode tomorrow because of the national debt. It’s likely that our government will be able to keep kicking the can down the road for a long time.

We hope you stay on board with us and learn how to position your wealth for longevity in this powerful series. Understanding the massive change that’s taking place and making informed investment decisions could make the difference between incredible wealth and monumental losses.

Now that we’ve laid the groundwork, in the next bulletins, we’ll be digging into how different investment vehicles are impacted by these changes. We’ll also reveal specific strategies to protect and multiply your profits, so you don’t lose out on the next wave of investment opportunities.

Featured