Pre-selling Now, Delivering 2022

506C Investment for Accredited Investors Only

This Fourplex Buying Opportunity is Sold Out

Explosive Growth

A thriving economy with more than 4X faster job and population growth than the national average

Build-to-Rent Community

Investor-friendly new construction in highly desirable “Best Performing Small City” for 2021 and A-rated neighborhood

Reduced Investor Risk

The amount invested into the syndication is 30% down and is used as equity to build the project. You will complete your purchase once the units are built and “close” on your building with your loan.

Projected Returns (10 Years)

9.2%

Avg Gross Rent Yield

$91.1K

Avg Annual Gross Rent

3.1x

Equity Multiple

21.3%

Avg Annualized Return

Virtual Tour at Your Fingertips

Top Reasons To Request The Equinox Investor Kit

A super star metro with stellar population growth and a thriving economy.

This personal project of Neal and Anna is now expanded to include a small number of investors.

No partners or profit splits. Buyers have 100% control and receive 100% of the profits.

Eligible for fixed rate, long-term residential loans, with the ability to refinance and supercharge your returns.

Receive monthly cash-flow while building significant equity over time due to appreciation and declining loan balance.

Receive positive cash flow and 75% or higher occupancy from day one.

Property management from a leading Idaho Falls expert with 15 years of experience.

BONUS DEPRECIATION in year one against all passive income (and active income for real estate professionals).

Painless loan pre-approval working with the #1 fourplex lender in the U.S.

Investor-friendly new construction significantly reduces maintenance, increases tenant desirability, and comes with warranties and guarantees.

Inspirational image. Subject to change.

“The real estate landscape in Idaho Falls has shifted dramatically in the past three years, and we have witnessed a significant increase in demand for rental properties. Developers such as Grocapitus are a welcome addition… it is my pleasure to express support, on behalf of the City of Idaho Falls, for the residential project Grocapitus is constructing.”

Mayor’s Office of Economic DevT, City of Idaho Falls

Inspirational image. Subject to change.

The Equinox Idaho Falls Project

We are building a 66 unit townhome community of fourteen fourplexes and five duplexes. Each townhome unit is two stories and comfortably sized at 1,354 square feet, with 3 bedrooms and 2.5 bathrooms. The design features an open-living concept with large spaces for comfortable living.

By using stick-built construction we are able to complete the project extremely quickly using a simple, proven method that is relatively inexpensive.

Equinox Townhomes Idaho Falls has been designed to be investor-friendly while meeting the needs and desires of tenants, including:

9 foot ceilings on first floor

Luxury flooring and stainless steel appliances

Master bedroom with a walk-in closet and a private bathroom with shower

Private patio per unit

1-car attached garage with private driveway and abundant guest parking

Community amenities include a common courtyard, picnic tables, a playground, and a fenced in dog park and dog run.

Because it’s brand new, your property comes with a 10 year structural and a 12 month product warranty. Unlike older properties, you won’t have the expense and hassle of replacing the roof, installing a new hot water heater, or upgrading the HVAC system anytime soon.

AVINASH P., Grocapitus Investor

The Massive Real Estate Boom

Historically low interest rates and a severe housing shortage are causing record high home price growth, rising at the fastest pace since the early 2000’s.

Residential home sales are hitting peaks last seen in 2006, just before the bubble burst, but this time mortgages are stricter, down payments are higher, and a tight supply is supporting prices.

The residential real-estate market is on its biggest tear since 2006, just before the housing bubble burst and set off a global recession. Yet in nearly every meaningful way, today’s market is the inverse of the previous boom.”

– Wall Street Journal, March 2021

Home builders cannot build homes fast enough, and not enough homeowners are selling their houses, resulting in a severe shortage of housing inventory that cannot keep up with strong demand.

And the Federal Reserve has clearly signaled they plan to keep interest rates low for several years, which should continue to propel the real estate boom that is gaining steam.

“The characteristics of a bubble peak typically includes low or zero down payments, below market mortgage rates in first few years (to increase affordability), lower credit requirements, an ample/excess supply of existing and new houses for sale and homebuyer-investor speculation. Clearly, today’s housing market’s characteristics are far from those extremes.

The bottom line – This housing market looks like an early upsurge formation with a long way to go.”

Forbes, March 2021

Join us as we take full advantage of this massive opportunity to invest in the powerful housing market boom that is creating gangbuster returns.

Inspirational image. Subject to change.

“Occupancy rates in the area average about 99.3%. A healthy market is considered to be one with up to 8% vacancy.”

Western States Multifamily, Independent Market Study, Feb 2021

Idaho

Urbanites are saying goodbye to big city life in favor of less crowded, more affordable inland cities and towns in the U.S. Nowhere is this trend more evident than in Idaho, where the housing market is booming and out-of-staters are pouring in to take advantage of the state’s relatively affordable cost of living without the big-city traffic, making it one of the fastest-growing states in the country.

For businesses, Idaho has a vibrant entrepreneurial culture with low taxes, a balanced state budget, and a business-friendly regulatory environment.

It’s no wonder it has garnering numerous top rankings, including:

“The market is expected to remain in balance through 2024. The project should have strong appeal to the market as it is located in a desirable residential neighborhood.”

Western States Multifamily, Independent Market Study, Feb 2021

Why We Love Idaho Falls

Located in Eastern Idaho, Idaho Falls is a super star metro with explosive growth and a thriving economy. It has best-in-the-nation job growth from a diverse range of industries. Last year alone, Idaho Falls saw the fastest job growth rate in the country during Covid and experts are predicting future job growth of over 40% in the next decade.

Here are some awards and accolades that highlight why we think Idaho Falls is a phenomenal metro for real estate investors:

For real estate investors, Idaho Falls is a dream come true, with a vacancy rate that is actually negative. Because no rentals are available, people are signing leases on units that haven’t even been built yet, making it a great time to be building rental properties in Idaho Falls.

With high-paying jobs and remote working the new norm, Idaho Falls is an attractive place to live. People are moving here because of the jobs, quality of live, and the diverse economy. We see nothing but good news ahead for real estate investors that invest in this metro.

2020 home appreciation was an epic 17.1% according to Zillow data and in February 2021, Local Market Monitor projected home values for Idaho Falls to increase by 13% in 2021 vs a 2.1% national average. And they ranked Idaho Falls the #1 U.S. market with the highest forecast home value increase!

ANSHU S., Grocapitus Investor

Micro Neighborhood

The project site provides an unparalleled opportunity to develop a landmark community in one of the fastest growing areas of Idaho Falls.

Only a few minutes from downtown, it is surrounded by affluent residential communities and is in close proximity to Idaho Fall’s largest employers and three universities. There is convenient access to the regional airport located only 10 minutes away, as well as Boise to the west and Salt Lake City in the southeast.

The neighborhood is stellar, with higher income than 72% of neighborhoods in the nation, due in part to the high number of white collar jobs at 57%.

All thanks goes to explosive population growth over the last five years, at 16.8%, within half a mile. Job growth is at 9.3% in the last two years.

While the nation went backwards with a job decline of -6.4% during the pandemic, our neighborhood witnessed job growth of +5.6%!

Last but not least, the neighborhood has had home value appreciation of 26% over the past two years, which is phenomenal!

Western States Multifamily, Independent Market Study, Feb 2021

Property Management

Smart real estate owners know good property management is essential for a successful real estate investment, which is why Grocapitus thoroughly researched potential property managers in the area and selected Jake Durtschi.

Founder of Jacob Grant Property Management

Idaho Falls expert with 15 years of real estate investment experience

Developed and currently owns a 28-unit townhome community near Idaho Falls

Manages 750 residential units in Rexburg, Idaho Falls and Pocatello markets

Certified Property Manager (CPM) licensed by the Institute of Real Estate Management (IREM) and a licensed realtor in Idaho

Jake is also a great fit because he already has experience developing and operating his own townhome community which is very similar to ours, with similar finishings and the same builder. His project had an impressive 42 people on the waiting list before construction was even complete.

Watch an interview with Jake in the investor kit to learn more about the metro and property management for the project.

Inspirational image. Subject to change.

Grocapitus is a breath of fresh air. They do things differently and way better than their competitors. Thank you Neal for being an amazing leader to your team! I couldn’t be happier with the results so far. Looking forward to investing more in the future.”

SARAH L., Grocapitus Investor

Inspirational image. Subject to change.

Financing

If you will be financing your purchase, we have the #1 Fourplex Loan Originator Specialist in the U.S., Lane Aldrich, for you to work with. He has closed thousands of fourplex loans and can work with you immediately on pre-approval.

Lane is extremely knowledgeable and has helped investors in a variety of financial situations during his 12 years in the mortgage industry. He is recognized as a Top Rated Mortgage Professional by The Daily Herald Readers Choice Awards.

If you have existing properties, Lane can also assess whether you can refinance and pull money from your existing properties to use for your Equinox Townhomes Idaho Falls down payment.

In the Equinox Idaho Falls investor kit, you can watch a replay of a webinar where Lane covers all the details of financing a fourplex purchase.

Now is a fantastic time to take advantage of historically low loan rates and purchase a leveraged, income producing asset that is projected to appreciate.

MAJOR’S OFFICE OF ECONOMIC DEVT, CITY OF IDAHO FALLS

Generational Wealth Creation

When you invest in Equinox Townhomes Idaho Falls, your investment acts as the foundation for a long-term wealth-growth strategy.

From an income perspective, our conservative projections show net cash flow rising from $10.1K in year 1 to over $32.4K in year 12 on a hassle-free asset.

But what’s really spectacular is the equity that gets built up over a 30 year ownership period. Principal goes down over time as the loan is repaid (by your tenants). Plus, the value of the property increases due to rising rents year-over-year and appreciation.

The numbers in year 30 are eye-opening: with a 30% down payment of $281K now, your investment is projected to grow to $2.4 million dollars in equity.

And unlike stocks and traditional asset classes, real estate investors receive highly tax-advantaged returns by utilizing tax incentives such as depreciation, bonus depreciation, cost segregation, and 1031 exchanges. In fact, many real estate investors do not pay any tax on their cash-on-cash return.

When your property appreciates in value, you can refinance and take out tax-free money. This money can be spent or invested in a new property, while you continue to enjoy cash flow and appreciation on the original property.

Plus, you can pass these advantages to your children and grandchildren by passing your fourplex onto them in your estate plan.

When you invest with a specific goal in mind, it’s easier to make strategic choices. Take some time to really think about where you want to be in 15, 20, 30 or more years. Do you want to be semi-retired? Fully retired? Debt-free?

Your fourplex is the vehicle that may get you to your goals.

Inspirational image. Subject to change.

Introducing the Development and Management Team

Neal Bawa

Grocapitus

Development

Anna Myers

Grocapitus

Development

Pete Levine

Grocapitus

Acquisitions & Development

Jake Durtschi

Jacob Grant

Property Management

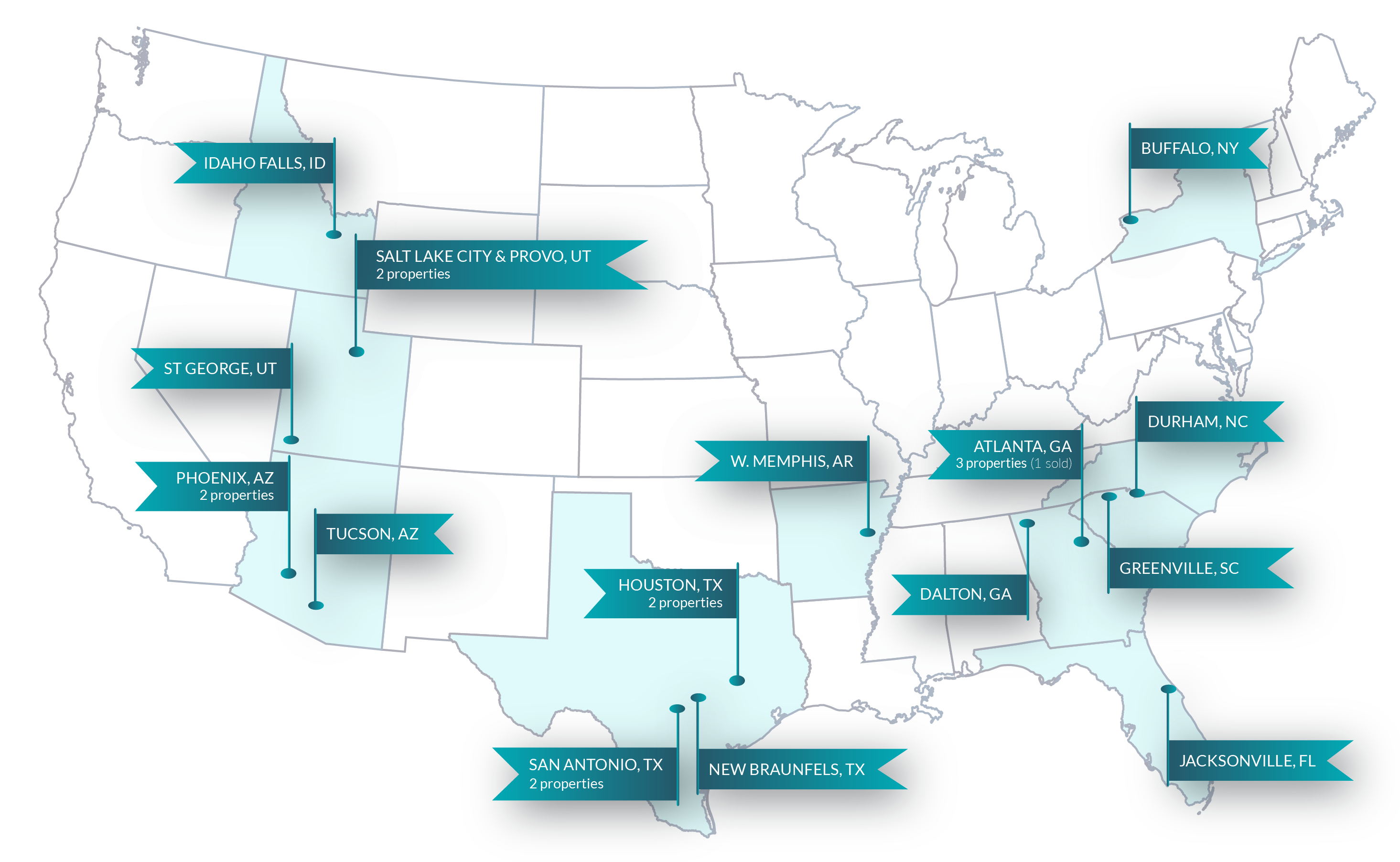

How Grocapitus Selects Development Markets

Rent Growth

Sales Trends

Employment

Supply And Demand

9.2%

Avg Gross Rent Yield

$91.1K

Avg Annual Gross Rent

3.1x

Equity Multiple

21.3%

Avg Annualized Return

Let Us Help YOU Receive MORE PASSIVE INCOME

© Copyright 2026 · Grocapitus Investments · All rights reserved · Privacy Policy