![FCC New Banner [ 2000x800px - Landing Page ]](https://grocapitus.com/wp-content/uploads/FCC-New-Banner-2000x800px-Landing-Page-.png)

Solo 401K, SD-IRA, QRP

506c for Accredited Investors only

Short-Term Investment Highlights

Higher Cash Flow With Lower Risk

Receive higher cash flow and robust returns with significantly reduced risk in a short-term investment compared to common equity in our value-add multifamily projects.

Preferred Returns

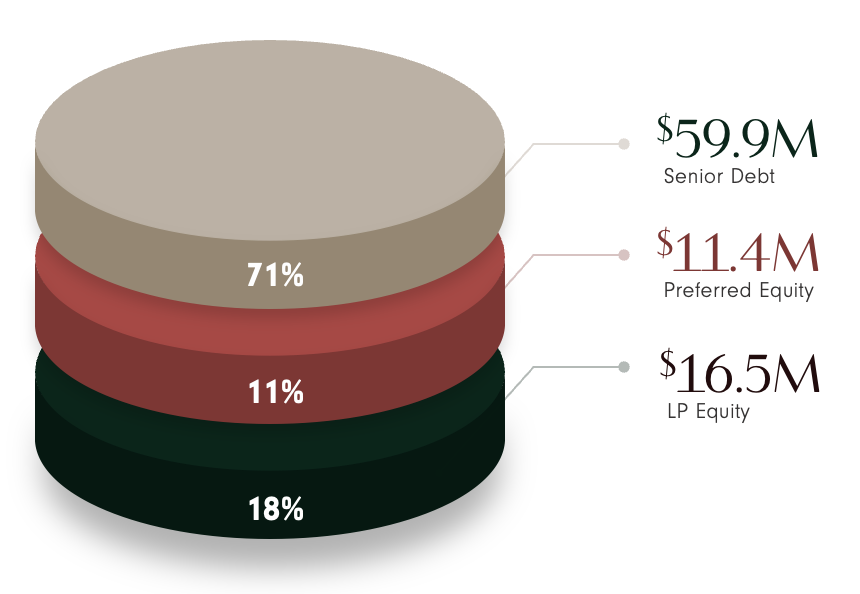

Pref equity is higher in the capital stack so all $16.5M in investor equity would have to be lost first, for you, as a Pref Equity investor, to lose money or lose cash flow.

Lease-up and Stabilization

Pref Equity for The Falls at Crismon Commons is predominantly needed for working capital during lease-up and stabilization of this gorgeous, brand new Class A apartment community.

14%–16% Pref Equity Opportunity Investor Kit

The Deck / Investment Summary

The FAQ Document

The Investor Docs Kit

The investor presentation

Where should we send your 14%–16% Pref Equity Opportunity- Investor Kit Access?

An accredited investor, in the context of a natural person, includes anyone who:

Has earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior 2 years and reasonably expects the same for the current year,

OR has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person's primary residence).

Short-Term Preferred Equity Returns (Per Year)

14%–16%

Annualized Returns: Split Between Cashflow and Backend Profits

7-8%

Annualized Cash Flow from Day 1

7-8%

Annualized Backend Profits

$100k

Minimum Investment

The Unique Benefits of Pref Equity

Have questions? Schedule a 1-1 call with our Investor Relations team

Take a Quick Tour of this Stunning New

Class A Apartment Community

Why This Could Be One of Our Lowest Risk Offers Yet

Safer Than LP Equity

The Pref Equity is senior to ~$16.5M of invested equity and has priority for both equity and cash flow

Short-Term Investment Timeframe

Less than 2-year projected investment timeline with high annualized interest returns

Immediate Guaranteed Cash Flow

Pref Equity quarterly cash flow starts immediately, and has priority over regular equity

Located in High Growth Market

Maricopa County is the 4th fastest growing county in the U.S. and Phoenix-Mesa was ranked as the #2 Multifamily Market in 2024 by Berkadia

Brand New Class A Apartment Community

This property is a highly desirable and well-located Class A asset proximate to a plethora of amenities

Project History | The Story of The Falls

The project originated in 2017 when our highly experienced development partners, Overland Group, secured a contract for the land and embarked on pre-construction activities to build 240 units with 255,611 total rentable SF. Major milestones include:

2017: Initial Contract and Planning

2020: Official Approval, Permitting and Financing

The project gained unanimous approval from the planning commission. A short time later building permits were secured and the construction loan was arranged, setting the stage for physical development.

2021: Groundbreaking and Construction

Q1 2024: Phase 1 Completion

The clubhouse and the first major building of 164 units are finalized, marking a milestone in the project’s timeline, and lease up begins.

Final Phase:

- Over 50% leased

- 100% construction complete for all 240 units!

- The Final Certificate of Occupancy (CO) for the entire property is expected before Christmas. We already have the Temporary CO for Building One.

Our Top Ranked Metro

To truly grasp why Falls at Crismon Commons is considered a trophy property, you need to step back and appreciate its exceptionally prime location. Maricopa County is the 4th fastest growing county in the U.S. after leading the nation for 3 consecutive years! This trend and its many other accolades showcases the region’s attractiveness, bolstered by a favorable climate, robust economy, and high quality of life.

#1 Population Growth, Maricopa County

Census, 2023

#1 Best Cities for Retirement, Scottsdale

Niche, 2023

#1 Top Markets for Talent Attraction, Maricopa County

Lightcast, 2022

Wall Street Journal, 2023

#1 Manufacturing Growth, Phoenix

Newmark study, 2024

Phoenix-Mesa, AZ, within Maricopa County, is a high-growth metro that is evolving into a technology and services powerhouse.

Phoenix-Mesa Housing and Multifamily Markets

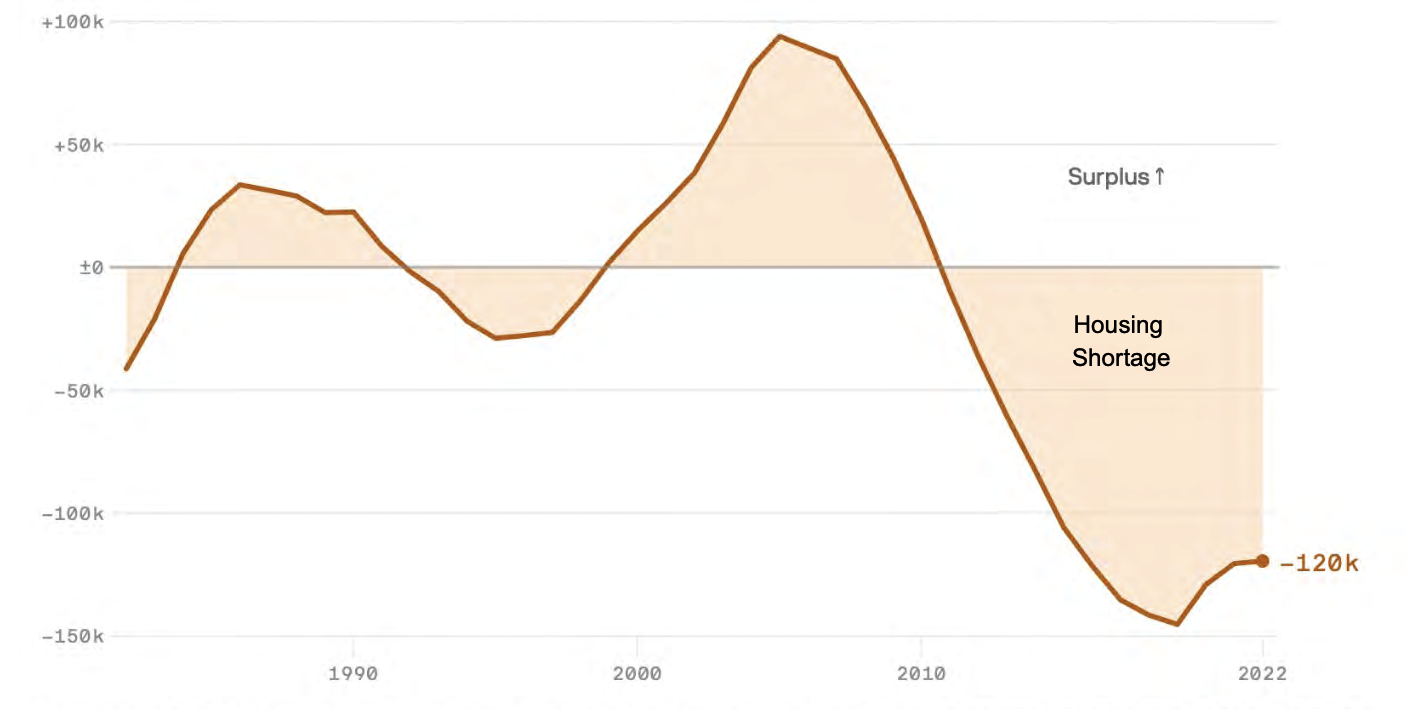

In the Phoenix-Mesa region, the astounding mismatch between housing availability and population demand presents a compelling case for investment in multifamily properties.

An analysis by Hines from January 2024 indicates the area is facing a shortfall of approximately 120,000 homes, which is ~6.5% of its total housing inventory.

#2 Best Multifamily Market in in 2024

Thanks to strong recent population and employment growth, a rise in supply and demand, Berkadia forecasts Phoenix-Mesa will earn the second spot in the nation this year.

As a result of the housing shortfall, there is a compelling case for multifamily to fulfill this gap and cater to the region’s housing needs.

Existing housing units relative to population demand in the Phoenix metro area

Annually; 1982-2022

14%–16% Pref Equity Opportunity Investor Kit

The Deck / Investment Summary

The FAQ Document

The Investor Docs Kit

The investor presentation

Where should we send your 14%–16% Pref Equity Opportunity- Investor Kit Access?

An accredited investor, in the context of a natural person, includes anyone who:

Has earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior 2 years and reasonably expects the same for the current year,

OR has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person's primary residence).

Why is Pref Equity Needed?

Rising interest rates have had a large impact on project costs, as a result, the anticipated annual interest on the construction loan has increased.

There has been an increase in supply of units in the Phoenix rental market, so we are being conservative with our rental rates, and we are increasing our expected lease-up period from 10 months to 12 months.

The Phoenix multifamily market has a forecast for rent growth resurgence in mid-2024. By mid-2025 robust rent increases of 4% are forecasted.

Our Business Plan

We have refinanced from the current high interest rate construction loan to an interest-only 3-year variable loan. We will be monitoring the following criteria closely to achieve an optimal exit, which is when Pref Equity will exit:

Market cap rates

Class A assets in the Phoenix-Mesa market remain a solid investment with cap rates projected to stay below 5% and trend downward.

Phoenix rent rates

We will be watching for rents to rebound in Phoenix, which may happen in 2024 or 2025.

Lease-up and stabilization

We plan to go through initial lease up, followed by renewal of first leases to bring rents to market rates.

– Munaf Z

How the Pref Equity Works

The Pref Equity class is a new equity tier that is senior to current shares. Therefore, your investment has a $16.5M cushion, reducing your risk.

Pref Equity Investors Receive:

14%–16% annualized interest, sitting above common equity in the capital stack

7-8% annualized cash flow distributions starting immediately, distributed on a quarterly basis.

7-8% annualized back-end return when the equity is projected to be paid back when the project is sold, which is expected to be in 18 – 24 months.

Benefits for Pref Equity Investors

Although the upside is capped for new Pref Equity investors, there are many benefits that make it a great choice for many investors:

It is higher in the capital stack and is paid back PRIOR to any regular equity getting paid, giving it a lower risk profile.

Pref Equity investors receive their cash flow prior to any regular equity cash flow

This Pref Equity investment is an outstanding opportunity to profit from an outstanding Class A apartment community that has faced higher costs due to unprecedented market conditions. We are very optimistic about our plan to exit the property in 18-24 months.

This is an unusual chance to join us in a short-term lower risk, higher cash flow investment in one of our flagship construction projects.

14%–16% Pref Equity Opportunity Investor Kit

The Deck / Investment Summary

The FAQ Document

The Investor Docs Kit

The investor presentation

Where should we send your 14%–16% Pref Equity Opportunity- Investor Kit Access?

An accredited investor, in the context of a natural person, includes anyone who:

Has earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior 2 years and reasonably expects the same for the current year,

OR has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person's primary residence).

The Falls at Crismon Commons Management Team

Neal Bawa

Grocapitus

CEO & Founder

Anna Myers

Grocapitus

COO & General Partner

Dave Holman

Overland Group

President of Construction

Michael Holman

Overland Group

VP, Development and Finance

Rudy R., Grocapitus Investor

This material does not constitute an offer or a solicitation to purchase securities. An offer can only be made by the Private Placement Memorandum (PPM).The PPM and its exhibits contain complete information about the Property and the investment opportunity. The information contained herein is not a substitute for an investor’s complete review of all of the information attached to the PPM as part of their own due diligence regarding this investment opportunity and its suitability for their investment portfolio.