This Syndication Is Fully Subscribed and Closed To Additional Investors

Projected Investor Returns

22.93%

AAR

2.15x

Equity Multiple

18.58%

IRR

8%

PREF

QRP, Solo 401K, SD-IRA

For Accredited Investors

A UNIQUELY RESILIENT AND FLEXIBLE PROJECT FOR UNIQUE TIMES

Outperforming Neighborhood Located In a Hot Metro

In Demand Ultra Modern Design With Corona-Resistant Amenities

Innovative No Debt Option*

*With our preferred exit option, we project paying back debt after construction

Real Estate in a Post-Corona World

The coronavirus has altered life as we know it and in ways that we are just starting to comprehend. We expect an extremely high reliance on social distancing long into the future.

Dr. Fauci says we will never get ‘back to normal’ because coronavirus ‘threat’ will remain.

Coronavirus has also altered the business environment. Which stocks are going up today? The ones that will be more in demand in a post-coronavirus world.

Real estate is no different, except that University Oaks is the only SBMF (small balance multifamily) loan eligible product that from multiple angles is a “corona-resistant” rental product. We’re at the forefront of what the market was already looking for, which is now boosted by the times we are living in, and remnants that will remain for years to come.

But as you will see, that is just the beginning. University Oaks is the perfect project at the perfect time for investors and delivers a superior tenant experience for our rental community.

Strategic Shared Public Space

No elevators, pools, spas, fitness centers, community centers, or indoor shared amenity spaces.

Delos Darwin Healthy Home

A branded Healthy Home by the #1 Health and Wellness real estate company in the world that invented the WELL Building Standard.

Stay At Home Conducive

Larger rooms facilitating more time at home. Larger windows and a balcony for fresh air.

Work From Home Friendly

Spacious 2 bed 2 bath units can comfortably accommodate a SOHO “Small Office Home Office” in the second bedroom.

Welcome to the New Reality and Grocapitus 2.0

While we didn’t see the pandemic coming, as part of our strategic plan for 2020 Grocapitus was already in the process of morphing as a company, and changing our approach due to trends in the industry.

And with the expectation of an overdue recession lurking in the future, we were already looking for ways to create higher resilience and rapid execution.

We knew we needed unique differentiators and lower risk options for investors. We were also seeking alternative approaches for new debt challenges.

Our partnership with Urbanist on University Oaks is the culmination of months of creative thinking and strategic planning.

Thinking outside the box and partnering with an innovative developer allowed us to bring you this stellar investment opportunity.

University Oaks is a resilient investment in a COVID-19 world due to the level of certainty and flexibility it brings in uncertain times.

We have pre-approval for the construction loan and no expected permit delays

Multiple exit options that allow us to be nimble and optimize returns based on a variety of economic recovery scenarios

Much larger pool of potential buyers at exit

Wellness real estate, a growing asset class that is a goldmine in COVID-19 times

Optimized amenities desirable post-pandemic

Why Did We Pick Houston

Houston, the 4th largest U.S. City, is also one of the fastest growing metros. Here are some awards and accolades that higlight why we are “hot for Houston”

#1 Fastest-Growing City In America

#1 U.S. Best Places To Live

#1 Best Market To Purchase MF Assets

#1 U.S. Best Cities For Millennials

#2 Top Metro For Job Growth

Did you know Houston was one of the least effected cities during the last recession of 2008? It’s property prices were some of the most stable in the nation while many other large city real estate prices crashed. In fact, Houston has been one of America’s best long-term real estate investments over the last decade!

With the large expansion at the world-class Texas Medical Center (see below) and its resilience during times of recession, Houston hits all the sweet spots when it comes to “Most Likely to Succeed In A Coronavirus World” and was our first choice for launching our innovative Grocapitus 2.0 investor optimized product.

What’s Special About The Neighborhood?

The analysis gets even better when we look at the University Oaks neighborhood, which outperforms the Houston metro as a whole and has many employers positioned to do well even in a coronavirus challenged economy.

There is a plethora of mega-employers and large student populations within a 10 minute drive that are a perfect fit for our new innovative offering, many with large expansions underway:

Texas Medical Center Phase 3 - $1.5 billion expansion

Rice University - +7,000 Students

University of Houston - +46,000 students

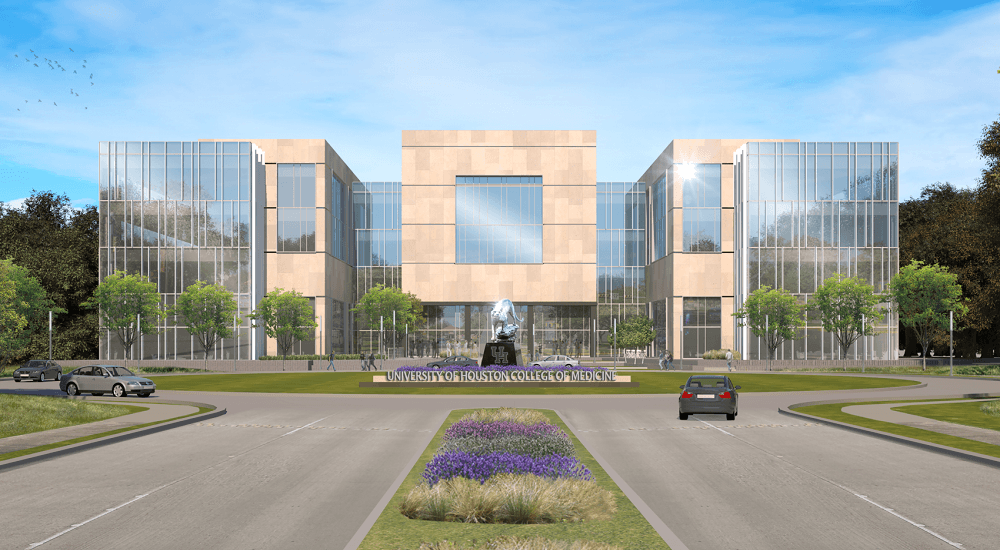

University of Houston Medical Campus - new $100 Million College of Medicine

University of Houston Law Center - New $90 Million Expansion

Neighborhood real estate appreciated a whopping 72.94% over the last 10 years and 144.5% since 2000. The area outperformed the notably strong Houston appreciation, a major feat.

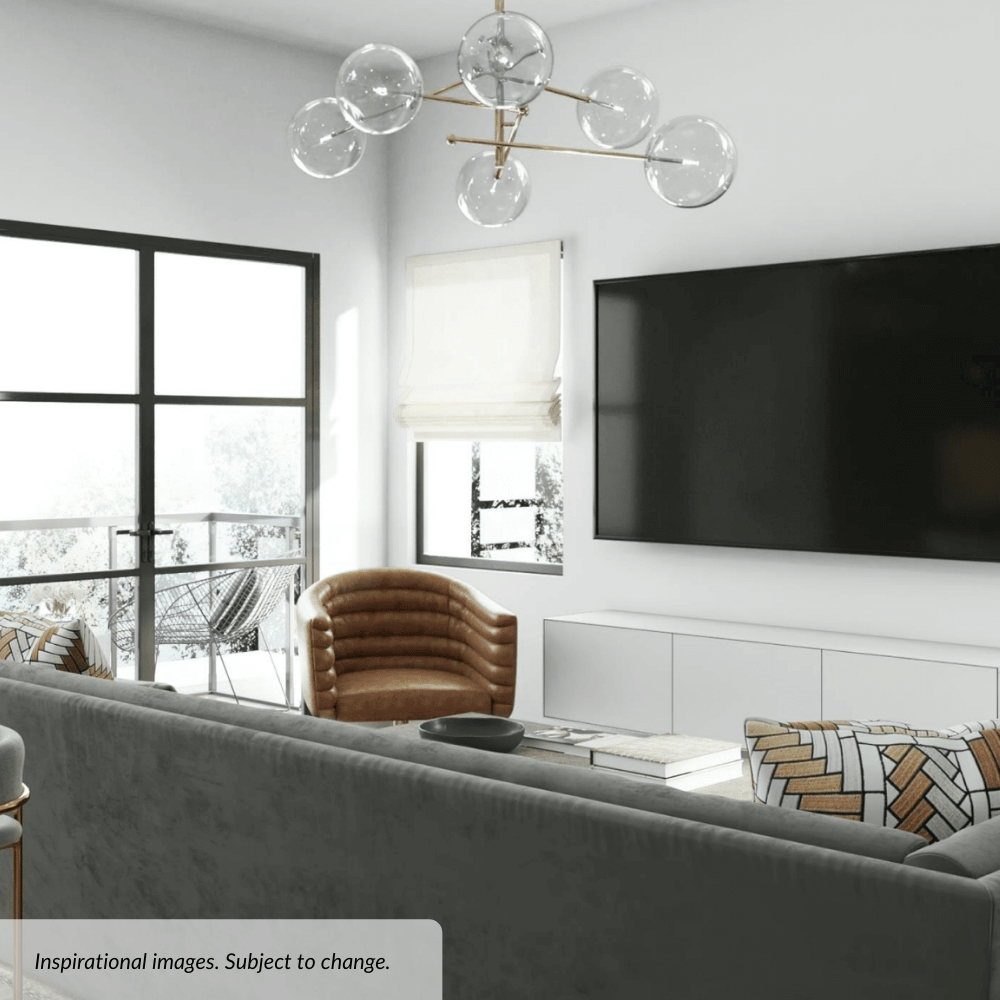

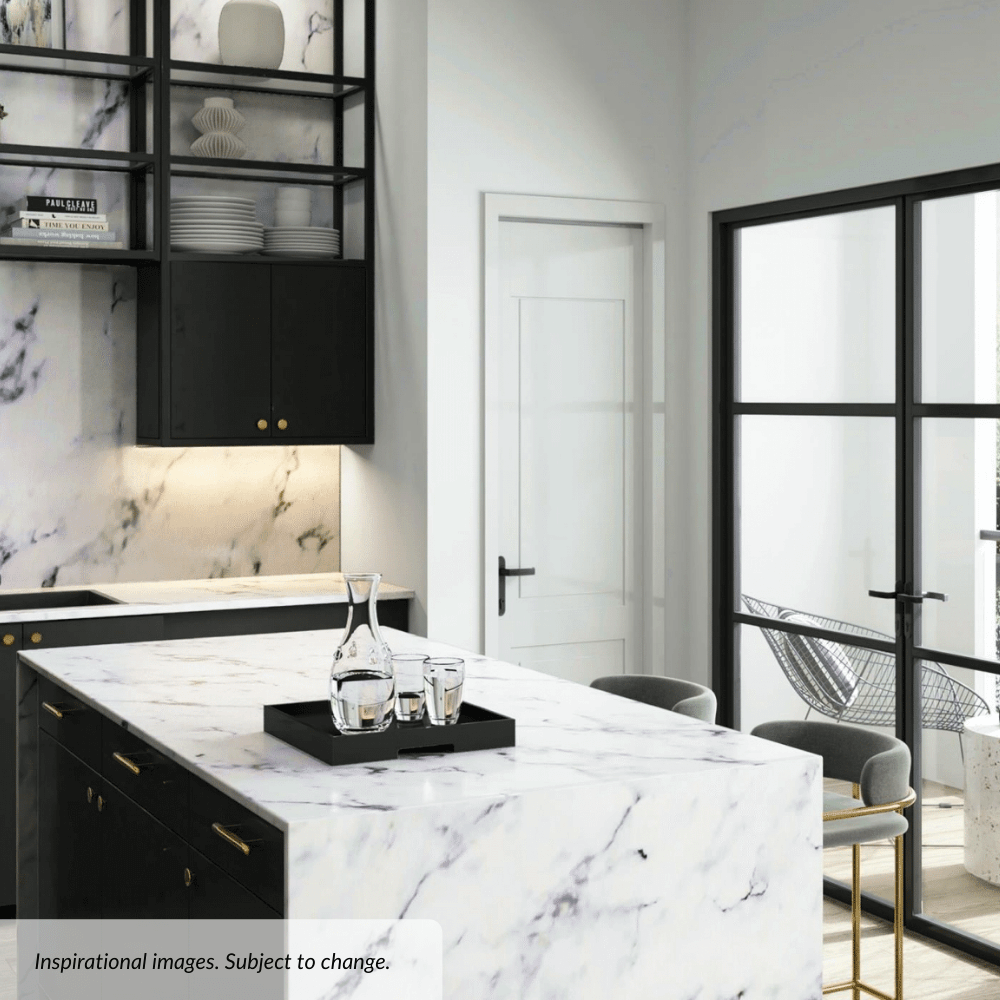

Affordable Luxury In A High Demand Ultra Modern Design

University Oaks is an architectural dream with modern, optimized amenities that are rarely found in even the most progressive multifamily and student housing developments. There is absolutely nothing like it in the area. Interior amenities include:

Superior finishes throughout

10 ft ceilings

High end wall finishes

Delos Darwin home intelligence wellness system

An exquisite walk-in closet

Who would not want to live in these apartments? They look like $1 Million Californian properties. We’re putting the money where it matters most – where you can see it! Instead of spending money on elevators and concrete construction, the money is being spent on the interiors.

This will have mega-appeal to a wide range of renters including medical staff, patients, and families; undergrad and grad students; graduates; research fellows; teachers; university employees; professionals working downtown; service providers; etc.

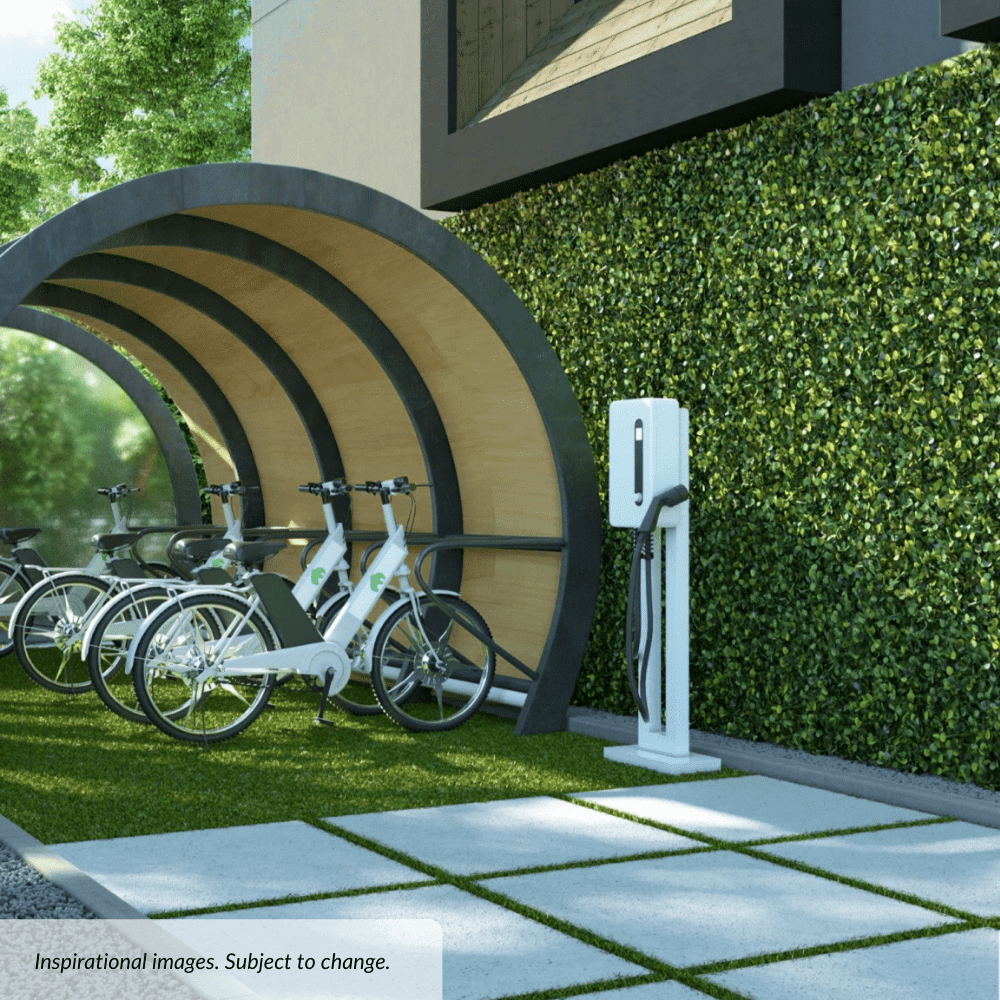

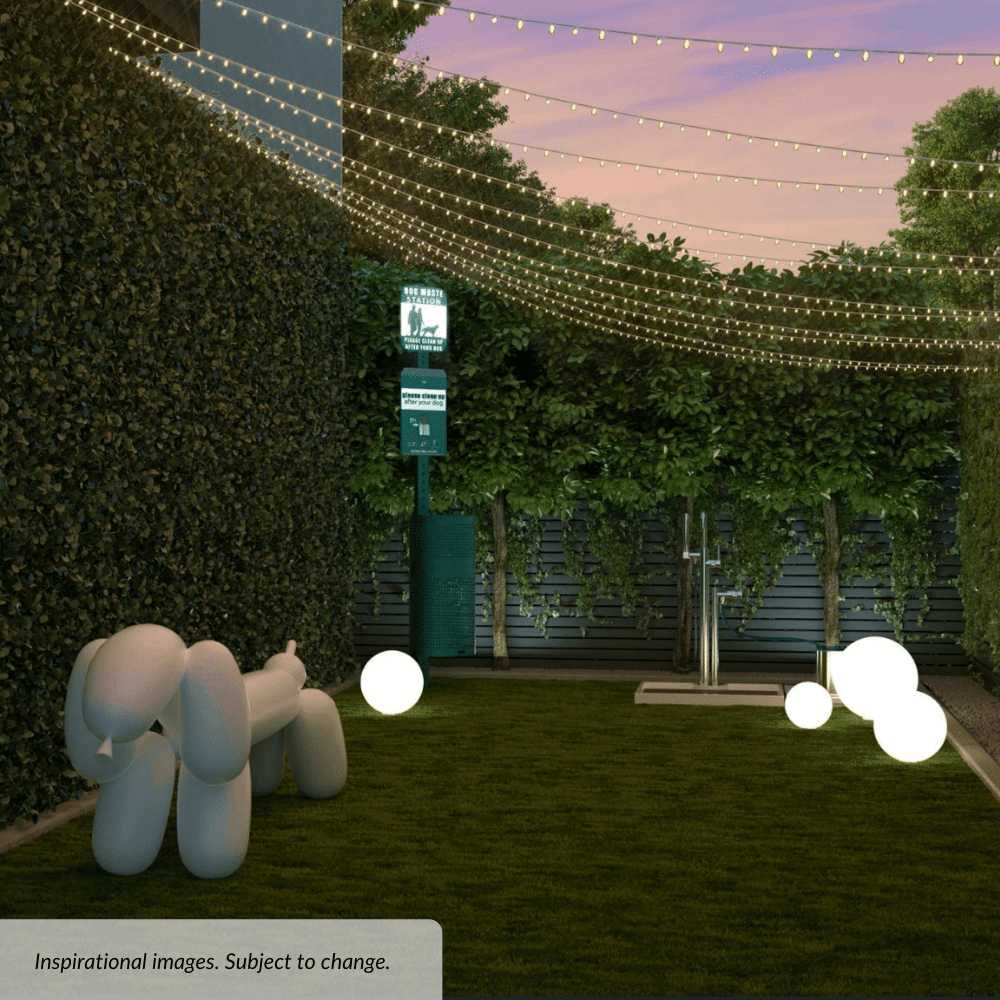

Corona-Resistant Outdoor Amenities

Replacing large gathering areas, pools, and play grounds are 6 boutique, private outdoor spaces which include:

Secret gardens with zero scape boxwood hedges

Firepit lounge

Private dog park

eBike amenity space

EV charging station

Gated security with 24/7 video surveillance

All outdoor areas are designed and constructed for low cost and low maintenance. Each unit comes with a dedicated eBike, giving residents a convenient transportation option.

Conveniently located across the street is a large, beautiful park, providing outdoor recreation options.

Your Health Matters

At Grocapitus, we saw wellness trends in real estate a while age, long before COVID-19 pushed them into the international spotlight. That’s why we jumped at the chance to create a Delos Darwin-driven boutique multifamily community. Delos invented the WELL Building Standard.

The system intuitively responds to the conditions in your home, purifying your air and water and providing dynamic lighting designed to restore your body’s natural rhythms.

Purified air

Purified water

Circadian sleep environment

Our team realized immediately the potential for the University Oaks community to attract (and keep) high-quality, upper-income tenants, both students, and professionals by incorporating a state-of-the-art home wellness system in a pandemic challenged world.

Plus, wellness-branded homes sell for 5-35% more, while wellness rentals command a 7-10% rent premium!

Innovative Investor-Friendly Exit Options

What really makes this investment opportunity shine and puts it in a league of it’s own is the flexibility we have with exit options due to the creative structure of the Grocapitus 2.0 investor-friendly product offering we are launching for this project.

Unlike our past syndications, we have 4 different exit options available to us that we will explain in the investor presentation.

In our default option, we hold for 5 years, but we have a creative approach that allows us to hold debt-free for most of the project’s timeline, giving us equity level returns at debt level of risk.

Our alternative exit strategies provide us flexibility depending on whether the recovery is going better than we expect, or if it is taking longer than we currently anticipate.

We can’t wait to show you each exit strategy in the investor presentation!

Introducing Our Innovative Development And Manage Teams

Neal Bawa

Grocapitus

Anna Myers

Grocapitus

Jonathan Bursey

Urbanist

Cole Popper

Urbanist

22.93%

AAR

2.15x

Equity Multiple

18.58%

IRR

8%

PREF