Are you ready to create

long-lasting wealth faster?

passive income investing in tax-advantaged

commercial real estate.

Welcome to Grocapitus. Smart Real Estate Investing Made Simple.

1000

1000+ Investors have invested in Grocapitus projects, with $200 million+ equity invested

21

21 projects (9 sold) diversified across 11 states over 17 metros

4400

Approximately 4,400 units/beds

$500 Million

$500 Million value of projects

(as completed value)

Our Mission

Grocapitus Investments exists to find and present rock solid commercial real estate investments to our highly valued capital partners. In addition to producing attractive risk-adjustments returns for our investors, we strive to enhance the life of every tenant, team member and individual that comes into contact with our business.

What We Do

We help people become financially free by investing in apartment buildings and build-to-rent townhomes/communities in high-quality markets nationwide. To accomplish this on a consistent basis, Grocapitus’ high-caliber team executes our proprietary data-driven process for identifying, acquiring, managing, stabilizing, optimizing and divesting cash-flowing value-add Class B and C properties.

We also build best-in-class new construction multifamily apartments and build-to-rent communities.

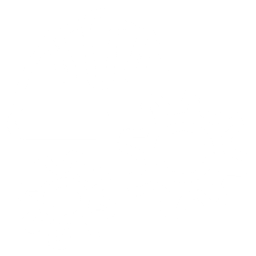

Portfolio

25 Projects in 11 States

Where We Have Properties And How We Select Markets

Rent Growth

The 5 year rent growth forecast is one of our key indicators. We use a powerful proprietary method to calculate this value.

Sales Trends

We continuously monitor local sales to compute cap rates and determine whether our cap rates are on target to reach our projections.

Employment

We look for metros and submarkets that are adding a significant number of high-paying jobs, resulting in a stable local economy.

Supply And Demand

We monitor the supply of local units carefully to ensure it will not spike the vacancy rates and negatively impact rents.

Giving Back To The Community

Meet Our Management Team

Neal Bawa

Founder/CEO

Neal’s Bio

Neal Bawa is a technologist who is universally known in the real estate circles as the Mad Scientist of Multifamily. Besides being one of the most in-demand speakers in commercial real estate, Neal is a data guru, a process freak, and an outsourcing expert. Neal treats his $500 million-dollar multifamily portfolio as an ongoing experiment in efficiency and optimization.

The Mad Scientist lives by two mantras. His first mantra is that, “We can only manage what we can measure”. His second mantra is that, “Data beats gut feel by a million miles“. These mantras and a dozen other disruptive beliefs drive profit for his 1000+ investors.

Jen DeVore

VP of Marketing & Operations

Peter Majeski

Director of Investor Relations

Tiffany Cambio

Controller

Kimberli Khepri

Director of Asset Management

Kristin Hancock

Tenant Marketing Manager

Casey Boston

Accounting Manager

Invest in a project like this

- The Grid Student Housing [ Video ]

- Coyote Creek Apartments [ Slideshow ]

- Mill Race Apartments [Slideshow]

The Grid Student Housing [ Video ]

This 217 unit student housing development in Buffalo, NY completed construction ahead of schedule, despite COVID-19 delays. The Building is leased up at over 96% and gorgeous! General Partners contributed an astonishing 85% of the equity for this stunning iconic project next to the Medical campus at the University. The project is refinanced and distributing 17% annually on current equity.

Invest in a Project like this

Coyote Creek Apartments [ Slideshow ]

This 116 unit new construction apartment complex in St. George, UT is fully built and consistently over 95% occupied. We raised rents multiple times during pre-leasing and current rents are coming in an average of 15% higher than originally projected. The project has refinanced out of construction lending and is currently distributing profits to our investors.

Mill Race Apartments [Slideshow]

Mill Race is a gorgeous multifamily development that was Opportunity Zone fund eligible. Initial construction encountered delays due to Covid-19. However, the project was re-scaled and value engineered to optimize size. Construction began in 2021 and was completed during the first half of 2023.

Featured Video

Neal Bawa, known as the “Mad Scientist of Multifamily,” delivered his highly anticipated 2025 Mid-Year Real Estate Trends webinar to a packed virtual audience. Backed by deep data and macroeconomic insight, Neal broke down what’s happening in real estate—and what’s coming next.

With inflation cooling, interest rates stabilizing, and political uncertainty on the rise, Neal focused on helping investors see beyond the noise and find high-probability opportunities across asset classes.

Featured Learning Opportunities

2025 Mid-Year Real Estate Trends

FREE ACCESS

Neal Bawa, known as the “Mad Scientist of Multifamily,” delivered his highly anticipated 2025 Mid-Year Real Estate Trends webinar to a packed virtual audience. Backed by deep data and macroeconomic insight, Neal broke down what’s happening in real estate—and what’s coming next.

With inflation cooling, interest rates stabilizing, and political uncertainty on the rise, Neal focused on helping investors see beyond the noise and find high-probability opportunities across asset classes.

Featured Podcast Interviews with Neal

GET IN TOUCH

Grocapitus Investments, LLC

![[ MOBILE ] EXL Phase II GRO Home Page Banner FCC Pref Equity](https://grocapitus.com/wp-content/uploads/DESKTOP-EXL-Phase-II-GRO-Home-Page-Banner.png)

![[ MOBILE ] Investor Club Website Banner -414 x 624 px](https://grocapitus.com/wp-content/uploads/DESKTOP-Investor-Club-Website-Banner-2000-x-800-px.png)

![[ 1200x675 Graphic (MFU Homepage) ] Location Magic](https://grocapitus.com/wp-content/uploads/1200x675-Graphic-MFU-Homepage-Location-Magic.png)