Grocapitus Opportunity Zones

Dramatically Reduce Your Capital Gains Taxes By Investing in Opportunity Zones (Pay as Little as $0)

Simply fill out the form below and we’ll have one of our friendly team members contact you with Opportunity Zones information.

What are Opportunity Zones?

OZs were created to boost economic activity in selected census tracts across the country. According to Brookings Institute there are 8700+ US Census Tracts designated as Opportunity Zones, out of which 19% are in already gentrifying areas.

What is an Opportunity Fund?

The Tax reform bill added Opportunity Funds as a new way to incentivize investment in specific communities called Opportunity Zones (OZs). An OZ Fund is an investment vehicle that invests at least 90% of its holdings in real estate within a Qualified OZ.

Why Invest in Opportunity Funds?

Opportunity Funds enable investors to defer federal taxes on recent capital gains until Dec 31, 2026, have that payment reduced by up to 15%, and pay as little as zero taxes on profits from an Opportunity Fund if that investment is held for 10 years.

How Investors Benefit

After selling an asset such as stocks or bonds, real estate, or interest in a partnership, an investor usually triggers a capital gain. These investors can receive special tax benefits by rolling their gain into an Opportunity Fund. The three primary reasons to roll your capital gain into an Opportunity Fund are:

Defer The Tax Payment

of your capital gains until Dec 31, 2026

Reduce The Tax

you owe by up to 15% after 7 years

Pay ZERO Tax

on gains earned from an Opportunity Fund

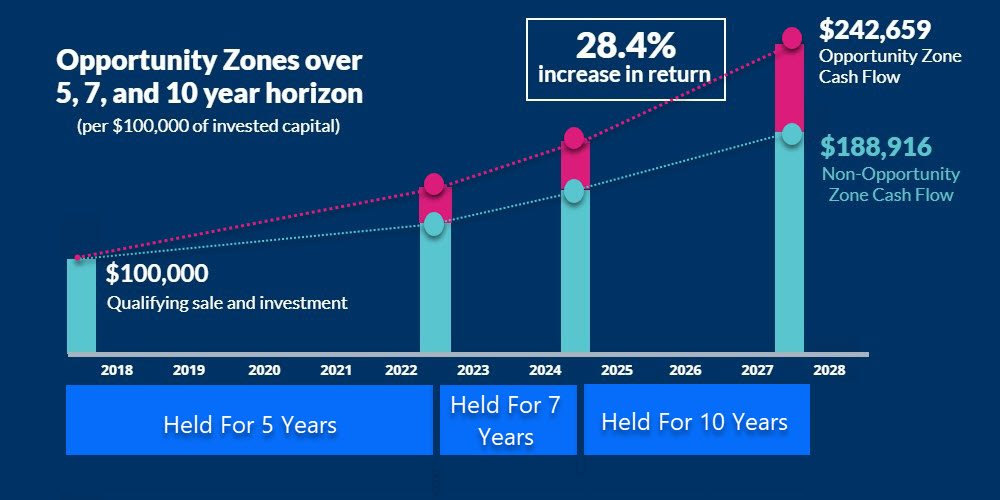

Opportunity Zone Benefits Over Time

Held for 5 years – 90% of original capital gain invested is subject to tax

Held for 7 years – 85% of original gain is taxed

Held for 10 years – The OZ investment step-up in basis to market upon disposition, resulting in no taxable gain

“$6.1 trillion is the total estimated unrealized capital gains that both American households ($3.8 trillion) and American corporations ($2.3 trillion) hold. Out of which, most experts believe OZ Funds will redirect as much as $100 Billion dollars into these regions.”

Simply fill out the form below and we’ll have one of our friendly team members contact you with Opportunity Zones information.

How Big is the Opportunity?

Total # of Opp Zones

%

% of US Population

%

% of US Tracts in List

Our Unique Data Driven Approach To Identifying Attractive Markets

With over 8,700 census tracts designated as Qualified Opportunity Zones, a data-driven approach to market selection is paramount to reduce risk and increase the rewards of Opportunity Zone investing. We use our proprietary market selection formula for identifying the most attractive markets.

Introducing Grocapitus Opportunity Zones

Grocapitus Opportunity Zones are focused on investing in high-quality real estate in major US cities with long-term growth potential. We plan to take on massive value-add properties and new developments in Opportunity Zones to maximize cash flow and returns.

The Problem

Through data science, we have learned that OZ projects vary a great deal in quality, because most OZs simply do not have the income, population or jobs to support new construction projects.

It is our core belief that a majority of OZ projects will not have positive outcomes for investors. Investors are only focused on tax benefits, not on project and area quality, and that is a big challenge.

Our Solution

Our current portfolio of $150 million in assets benefits greatly from our knowledge of Real Estate analytics. We bring that extensive knowledge and demographics secret sauce to Opportunity Zones.

How We Do It

We start with demographics and carefully target a fraction of nationwide zones. Then our team engages in a unique zone-by-zone outreach campaign , seeking out exceptional OZ projects.

Applying unique filters to markets, neighborhoods and potential developer partners, we source those rare OZ projects that present true opportunity, while minimizing the potential hazards of investing in underperforming areas.

Simply fill out the form below and we’ll have one of our friendly team members contact you with Opportunity Zones information.

Calculate Your After-Tax Returns

Assumptions: 12% annual rate of return; 10-year hold

Calculations above are based on the highest federal gains rates of 20% and 37%, with a 3.8% net investment income tax that applies to certain circumstances, for long-term capital gains tax of 23.8% and short-term capital gains tax of 40.8%. Any profits on the sale of an asset held for 1 year or less is considered a short-term capital gain and is taxed at ordinary income rates. Assumes no state income tax.

FEATURED NEW CONSTRUCTION FOURPLEXES

University Oaks | Houston, TX

Brand New Turnkey Fourplexes

5% Fixed interest rate for two years!

1031 Exchange, Solo 401K, SD-IRA, QRP

Opportunity Zone eligible

Modern design with luxury amenities for high earning population

Where should we send your "University Oaks Buyer Kit" access?

Learn More About Opportunity Zones

Opportunity? YES! But There Are Some Pitfalls As Well...

Lately, I’ve been researching issues which could spell trouble for Opportunity Zone Funds, and their investors, unless they become more pro-active and savvy in the way they design and manage such funds. Here are just a few of the dangers of Opportunity Zones I discovered.

Beware Of Garbage Opportunity Zone Projects

Of all the risks associated with Opportunity Zone investing, perhaps the most pernicious is the influx of what I call “garbage projects” into the marketplace. Discover how to spot garbage projects and the 5 key areas I evaluate for all of my own projects….

OpportunityZones vs 1031 Exchanges, What You Need To Know

As Opportunity Zones have come increasingly into the spotlight, it appears they may actually have several advantages that make them preferable to one of the most popular capital gains tax reduction vehicles – 1031 Exchanges. Discover the pros and cons…

An Exciting New Tax-Advantaged Investment

If you are going to realize a large capital gain in the near future, or are interested in collecting a portion of an existing unrealized capital gain, Opportunity Funds are one of the most exciting investment developments in recent history.

Grocapitus has identified several Opportunity Zone deals for investors who would like to take advantage of this monumental investment vehicle.